Dive Brief:

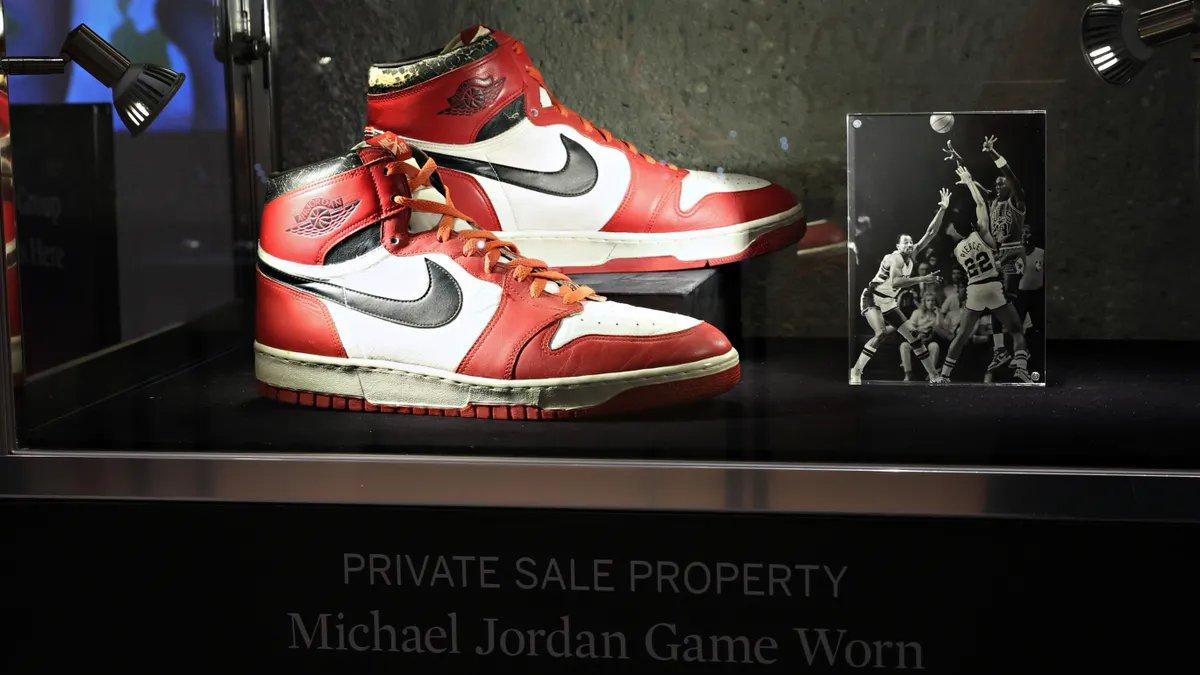

- Nike, Jordan and Adidas, in that order, were the top three sneaker brands in 2023 on trading platform StockX for the second year in a row, according to the company’s Big Facts: Current Culture Index report released Wednesday.

- Sneakers from designer Mihara Yasuhiro saw year-over-year growth of 1,502% compared to 2022, making it the fastest growing brand on the platform, followed by On Running, which saw a 695% growth rate. Trades of MSCHF brand footwear, including its viral Big Red Boots, grew 240%, while Asics trades increased 239% and Oakley sneaker trades grew 157%, due in part to the latter’s 1990s Factory Team reboot with collaborator Brain Dead.

- Ugg was both the top-traded and fastest-growing non-sneaker shoe brand, with 154% year-over-year growth in 2023. Women comprised 38% of platform users for the year, and a press release accompanying the report stated that women users were “vital to the growth of brands like Ugg and Asics.”

Dive Insight:

Running shoes continue to dominate the trend cycle as Asics sneakers jumped from the 10th most-traded sneaker brand in 2022 to the fifth most-traded sneaker brand in 2023. Retro Y2K running styles including the Asics Gel-1130, New Balance’s 530 and Nike’s Zoom Vomero 5 were especially popular in 2023, and StockX’s report predicts that there will be “even more demand for these mesh upper styles in 2024.”

Pool slides and sandals trades from Gucci helped make the luxury brand the second fastest growing shoe label, which StockX attributed to more customers traveling in 2023. Other popular luxury accessories brands included Jacquemus, which became the site’s third fastest growing accessories brand due to a 111% trade increase. Telfar dropped down one notch to become the third most-popular accessories brand, and Louis Vuitton jumped one spot to become the fifth most popular accessories brand. StockX said that with “Pharrell’s appointment, the brand is poised for a new chapter in 2024.” Supreme maintained its position as the top accessories brand, a place it’s held since StockX began reporting rankings in 2020.

Value was a big touchpoint for StockX shoppers in 2023 and that isn’t expected to change in 2024, per the report, which said that “future investment potential will play a bigger role in purchasing decisions” moving ahead. The platform noted that Louis Vuitton Bumbags and Goyard totes in particular showed consistent price appreciation.

Other brands that did well in 2023 included footwear brands Birkenstock and Crocs, which showed 70% and 51% increases in trades respectively, and Coach, which grew 77% in the accessories category. Fear of God stayed in its position as top brand in the apparel category for the second year in a row, with newer apparel brands including Denim Tears and Represent quickly gaining ground, improving by 694% and 361% respectively, year over year. Gorpcore mainstay Arc'teryx was the third fastest-growing apparel brand, and saw a 186% growth rate.

"We've continued to see strong demand on our marketplace, despite consumers having faced economic challenges over the last year," StockX CEO Scott Cutler said in the press release. He added that in 2024, the company expects “newcomers and challenger brands to continue to flourish and compete with heritage labels. By way of trends, we're forecasting bolder and more innovative designs and an emphasis on running, performance basketball, and competitive sport in hype culture."

Since its launch in 2016, Detroit-based StockX has served as a barometer of trends in collectible footwear, apparel and accessories. The platform, which also trades in electronics, trading cards, and other collectibles, began releasing trend reports in 2020, and also releases regular rankings throughout the year that track its fastest growing brands. The company reported over 50 million lifetime trades as of 2023, in addition to 15 million lifetime buyers and 1.7 million lifetime sellers.