Adidas CEO Bjørn Gulden has firmly eliminated the possibility of the athletics brand selling Yeezy products without the Yeezy name attached to them. That was floated in November last year, shortly after the end of the company’s partnership with Ye, also known as Kanye West.

But on Thursday, Gulden said on an earnings call with analysts that selling the Yeezy shoes without the name attached “is not an alternative.”

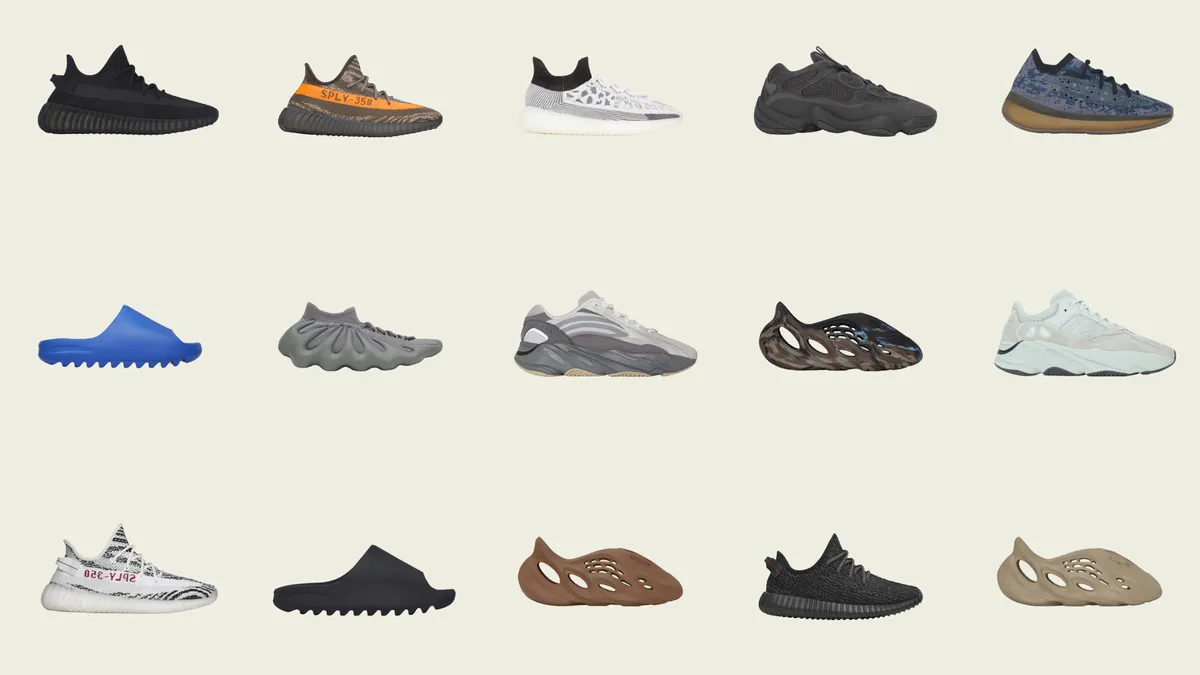

“The Yeezy product is something that he created, he’s the inventor of it and we have been his partner. To take his designs and sell them off later, which we technically legally could do, is not part of our strategy,” Gulden said. “Our task now is to limit the damage, get rid of the inventory, use the proceeds to good … and build a business later without Yeezy.”

Executives said the company made about 400 million euros (about $441 million at the time of publish) worth of sales thanks to the first sale of Yeezy products, which accounted for 20% of its total Yeezy inventory, and got rid of about 100 million euros worth of costs associated with writing the inventory off. Gulden added that the company will continue to gradually sell off its current inventory, but is not making any assumptions about how well it will sell.

“The uncertainty on each of these drops is so big and we don’t want to have people believing that we have sales and profits in the pocket,” Gulden said.

After raising its annual guidance in preliminary results released just last week, Adidas’ second-quarter earnings were roughly in line with those expectations. The retailer’s quarterly revenue fell 5%, and net income from continuing operations was 96 million euros.

In currency-neutral terms, sales in North America were down 16%, but executives noted that things would have been worse if it hadn’t sold the Yeezy inventory during the quarter. Without Yeezy, North America sales would be down 20%.

“The core adidas business was slightly better than we expected. Although we still have too much slow-moving inventory in the market, sell-through has been improving,” Gulden said in a statement. “We also saw gross margin in our core business improving strongly compared to the first quarter. The operating profit of €176 million was substantially higher than our initial plans. The sale of the first part of the Yeezy inventory did of course help both our top and bottom line in the quarter.”

The retailer reiterated its guidance for an annual operating loss of 450 million euros, down from its initial projections of 700 million euros, and added that it has not yet accounted for the sale of additional Yeezy merchandise, which is being released throughout August. While the sale of Yeezy merchandise has helped Adidas, “the company lost €400m from not selling Yeezy in Q1, so the loss of Adidas’ single most important revenue stream poses a fundamental challenge for the brand’s future,” GlobalData apparel analyst Alice Price said in emailed comments.

Price added that Adidas’ second drop of Yeezy merchandise is “a short-term solution for a brand that has lost some of its identity and relevance in the market, with its product offering behind the trends and not as innovative in comparison to its rivals.”